I disagree on all points.

This conversation has to be a "then and now" type of thing because the products have changed so much over the past few years.

Now-

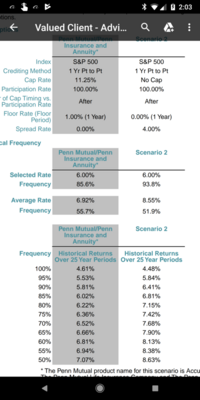

The EC5 outperforms the CV5 assuming the same Credited Rate.

At Preferred Rates and the same Credited Rate, it beats it with and without the Waiver of Surrender Rider.

The EC5 also produces more income, both with and without WOS.

The only real questions are:

1. Does the higher Cap on the CV5 justify running it at a higher Credited Rate?

2. Will they keep the Cap higher in the long run?

My opinions:

You are asking for trouble assuming the higher Cap will yield significantly higher returns in the future.

The next decade will not look like the past decade in the stock market. Assuming Caps will be maxed out as much as they have recently, is begging for an E&O claim imo.

With a moderate market, there will not be a large difference, or even any difference, between an 11% Cap and a 12% Cap.

From a historical standpoint, any Cap over 10% tends to give nominal return when compared at 30/40/50 year periods. Unfortunately, there is a reason the carriers lobbied the NAIC to only show a 20-year lookback on illustrations. Take a look at a 30 or 40 year lookback and it is very revealing.

You can always expect Caps to be lower in the future to some extent at some point in the policy. They might not stay that way, but it can and probably will happen at some point.

Saying "this product will have a higher Credited Rate than that product", is asking for trouble. It is also impossible for anyone to know for sure. Its not a game I play.

Product comparison in the past:

In the past, the normal CV product did outperform the EC product. But not by much. And the outperformance was even less on the income projection.

4% Spread Question:

I dont use it. From a historical standpoint (beyond 20 years) a Cap above 8% beats almost every other option out there. And it is by far the most consistent option. And consistent returns are key with life insurance.

I might use it for a small portion off my allocation. But never for the majority.

You are looking at numbers that include the past decade. If the next decade, looks like the decade before last, a 4% spread will be a horrible option compared to a yearly Cap.

I don't get which decades you specifically talking about . .. the past decade as in 07-17? or 01-10? .. It seems as if the 4% spread would do better in a volatile market. let's say a 30% down year and then a 30% up year .. but in a steady market where it's going up steadily, the cap is always better and the cap is less risky in general.

Don't get me wrong .. I understand the risk of the 4% spread, and I don't plan on selling it to my clients but it's an option that I think I would find viable for myself. But the risk to me seems like in a less volatile market where there are not a lot of big swings from year to year the spread option is really risky but the past decade has been pretty wild IMO.

See how there is a 50 year look back and a 66 yr .. the 50 yr look back still has a very good "worst case scenario" .. but in the 66 yr look back the penn option has a better "worst case scenario" ..