- 4,908

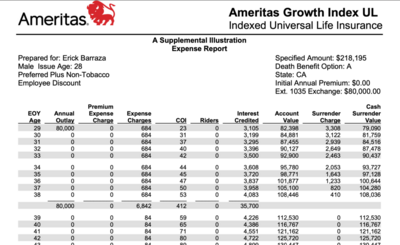

Any idea why people can’t post their initial IUL illustrations and actual performance for the past 20 years or so?

I am sure they can if they want to. Just like I could post what I was illustrated for my WL bought 15 & 16 years ago & shoe the current inforce that hasn't performed as illustrated.

I don't have access to any old IUL statements to show you