Edwardfin

Expert

- 50

As someone pointed out, if the insurance company could generate those returns with "minimal risk" they would just do it in their general account but guess what, they don't because they can't.

The historical crediting rates are hypothetical. The one index that you posted didn't even come out until Sept 2021.

These carriers just make up these indices, backtest them with the most favorable allocations, and post "historical" returns. They're the ones who cherry-pick, not me.

It's largely bullshit which you'll eventually find out.

P.S. I believe in IUL and that it can outperform other insurance products. But it's just that, an insurance product so it's stuck with insurance product returns which can have great years but over 20-30 years, the IRR is still going to be 4-6%, no matter what whiz-bang index the carrier claims to have.

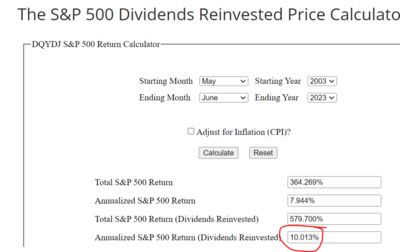

So there is a product that performs at 4-6% based upon your understanding with a leveraged death benefit and the ability to make use of positive arbitrage. The guaranteed loan ability at zero percent interest generally after year 10. A retirement income that avoids provisional income tests. The gains are for whatever reasons are sometimes compared to the market so since 2000 the S&P price has earned 5.9% (I didn't take away the tax burden if you do it's less- I also gave an average rate, not the actual rate or return if you use the actual rate it's less) with a front-loaded fee scheduled that when properly structured the customer will pay less in overall fees compared to the market over the life of the product. Oh and based upon the last 23 years it gives market-like gains without any risk of loss to the market. It sounds like I should talk to most if not all my customers about this product. Is that your conclusion?