- 10,806

But the person that posted the info sure seems to like it.

Like I said. Pac life has a crazy good marketing department. They can make a pile of sh*t look like an ice cream sunday.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

But the person that posted the info sure seems to like it.

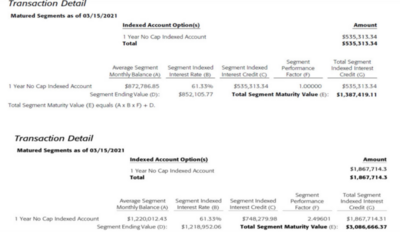

Yes, that is exactly what would happen. And if the S&P is up 100% in 5 years then the $100k becomes $370k. I'm 28 I like my chances of compounding at an average 9% tax-free better than having to stock pick or fund an IRA. Even without leverage, the 5 year index never had a return of less than 45% over 5 years since 2009. I don't mind taking a few negative months if the long-term trend is up. But you could always take away the multiplier at your anniversary.Do those other carriers have a 4.98% or 7.5% design charge.

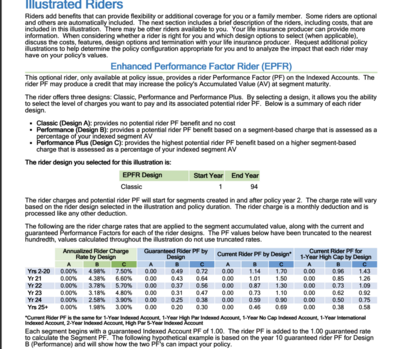

Honest question, in a flat year on $100k cash value, does this mean a client could would see their following anniversary be at $92,500 because of the 7.5% design charge in addition to whatever the annual COI charges are?

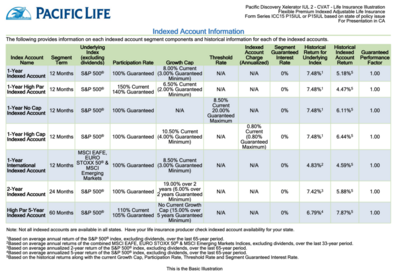

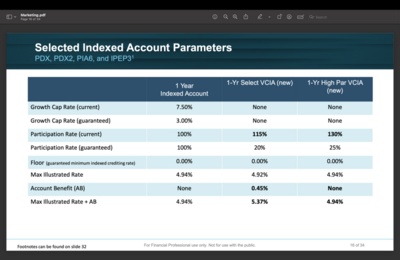

You're wrong on both points. The participation rate is guaranteed at no less than 100% and the performance factor by default is 1.0 which means nobody has to EVER use the multiplier if they don't want to. It's just nice to have access to a GUARANTEED minimum of 170% of the uncapped S&P 500 indexAh. I thought you were talking about an internal charge in the policy.

Yes. That is the charge for those riders.

7.5% deduction in index return to get a 2.7x multiplier.

4.98% deduction in index return to get a 2.14x multiplier.

The multiplier is not guaranteed and can be reduced to 1x at any time.

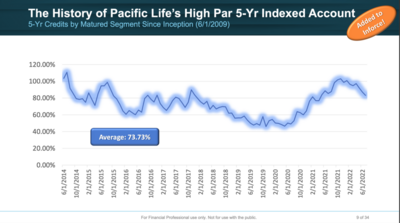

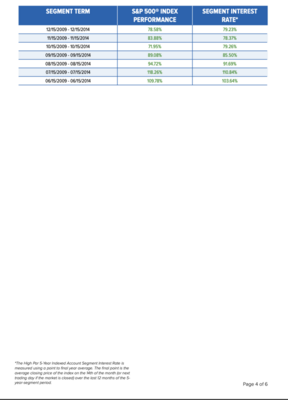

All the sales material Ive seen for this does not show how the index would have performed during the 80s/90s/early 2000s. They only show the largest bull market in US history.

Oh... and the participation rate on the index is not guaranteed.

Its not guaranteed and costs 7.5%.... and somehow Pac is able to spin this as a positive.... LMAO!!

over 5 years guaranteed at no less than 105% participation rate.

over 5 years guaranteed at no less than 105% participation rate.

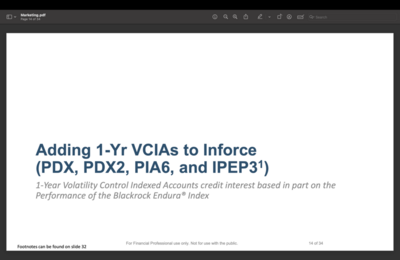

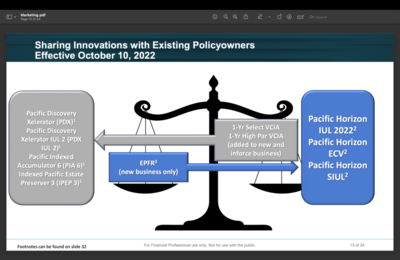

They haven't taken anything away. Where did you get that idea? They are coming out with a new Pac Life Horizon product and this new Volatility Controlled index is being added to in-force policyowners.Wow. I cant get over that Pac Life index switcheroo. What a FU to policy holders!!

Ive seen and heard about some sh*t in this industry. But SUPRISE, WE ARE CHANGING YOUR 0% FLOOR POLICY AND NOW YOU ARE AT RISK OF A 7.5%+ LOSS EACH YEAR!

Happy 2023!!

What a horrible thing to do to policy holders.

That is a guaranteed class action suit. Write it down, mark my words.

Allen needed a magnifying glass to see that fine print about a 7.5% Fee!!

Of course not, because that is the start of one of the longest bull markets in history (bolded).Yes, that is exactly what would happen. And if the S&P is up 100% in 5 years then the $100k becomes $370k. I'm 28 I like my chances of compounding at an average 9% tax-free better than having to stock pick or fund an IRA. Even without leverage, the 5 year index never had a return of less than 45% over 5 years since 2009. I don't mind taking a few negative months if the long-term trend is up. But you could always take away the multiplier at your anniversary.

View attachment 8357 View attachment 8358

Only on Sunday? What about the other days of the week. LOLLike I said. Pac life has a crazy good marketing department. They can make a pile of sh*t look like an ice cream sunday.

And if the S&P is up 100% in 5 years then the $100k becomes $370k

You're wrong on both points. The participation rate is guaranteed at no less than 100% and the performance factor by default is 1.0 which means nobody has to EVER use the multiplier if they don't want to. It's just nice to have access to a GUARANTEED minimum of 170% of the uncapped S&P 500 index

I'm 28 I like my chances of compounding at an average 9% tax-free better than having to stock pick or fund an IRA. Even without leverage, the 5 year index never had a return of less than 45% over 5 years since 2009. I don't mind taking a few negative months if the long-term trend is up.