ejbarraza

Expert

- 65

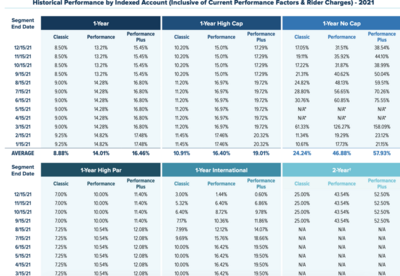

But you're wrong in that the multiplier's leverage is currently 270% years 2-20 and is GUARANTEED at 170% minimum and after year 25 the fee for the multiplier drops to 3% and a minimum 130% leverage on whatever the underlying index performs. If it's completely voluntary why wouldn't you want that leverage available as a feature? Also, the volatility controlled indexes are GUARANTEED to be uncapped for life. Even with the net cost of the multiplier you would still come out ahead over the long-term especially after a bear market crash.I never said the participation rate was not guaranteed.

I said the multiplier is not guaranteed. They can reduce it to 1x at will.

I am absolutely correct on both points. The multiplier options are a Fee that is directly deducted from the policy and can take it into the negative.

And multiplier of 1 is not a multiplier. Do the math.

Last edited: