- 2,211

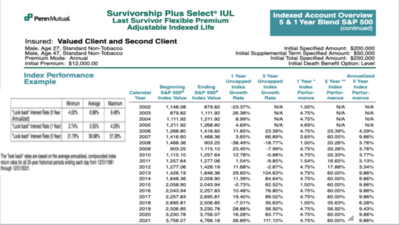

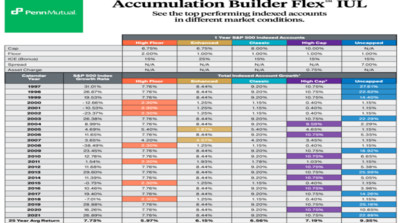

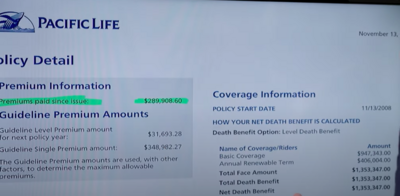

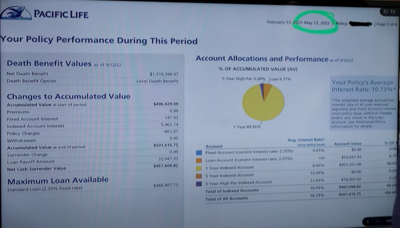

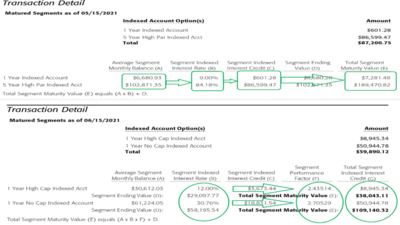

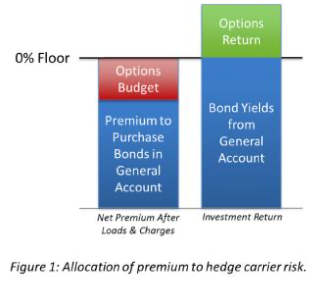

I love this question, but it does need a.... question mark [?]As of 12/31/21, the S&P 500 index was up 106% from its lows in march/april of 2020. Did the Pac Life product capture all 106% of that too along with the dividends that were credited from the 500 companies in the S&P

Perhaps someone will answer it at that point. There are really two questions that are in it and I am waiting for someone to approach it.