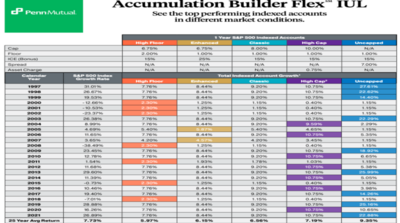

Good luck to you.Now people like you guys think it's a complete scam that Pacific Life can generate triple-digit returns under any circumstance.

Just ask yourself this: if Paclife could do that why doesn't every carrier? They are much smaller than other companies so why don't larger carriers capatilize on this strategy?

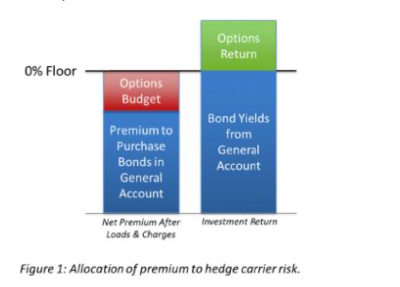

If they could generate those returns with options (which you sound like you're new to), why wouldn't they just put all of their general account (the heart of every insurance carrier) into them?

There is no magic bullet. Insurance carriers are inherently risk averse. They may offer great guaranteed crediting strategies one day, and then nuke your whole plan with max charges the next.

I think that you're drinking your own Kool-aid. Those of us who have done this for decades know that you're going to hose your clients down the road (not intentionally) but that's how it's going to be if you tell clients and IUL will outperform the stock market. It may for a few years, it won't for the life of the policy