Only selling one policy would be inexpensive because you'd just drop all of that stuff after it issued.I am still trying to work out the math of Getting and Keeping a Life Insurance license in California for the sole purpose of selling one policy - to yourself.

What is that about $188 a year, plus E&O, plus a GL policy. [Not considering CE]

That has got to be about a $1,000 a year or so? But for 14 years.

Admittely - you have received commissions.

I am not asking, and I do not want to know the exact details, but this is fascinating to me..

Good Luck.

You're not going to sue yourself, you don't need to be appointed to access the policy because you own it, and you can just let your license lapse.

It's why some carriers won't appoint you for just a conversion or controlled business.

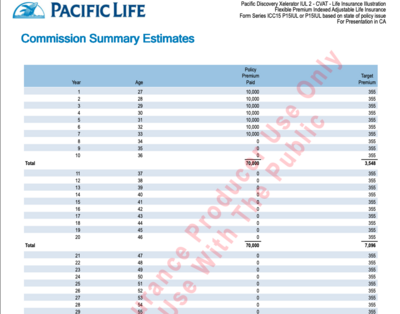

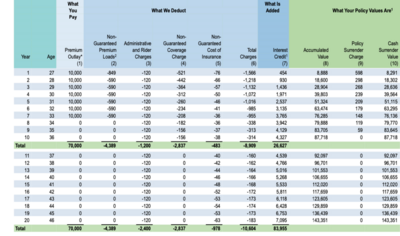

At 10k/yr, he probably made 3-4k (maybe a little more since Pac has some of the largest targets out there...which makes them pretty popular.)

If you can do it, it's worth it.