ejbarraza

Expert

- 65

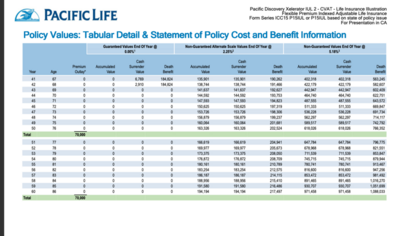

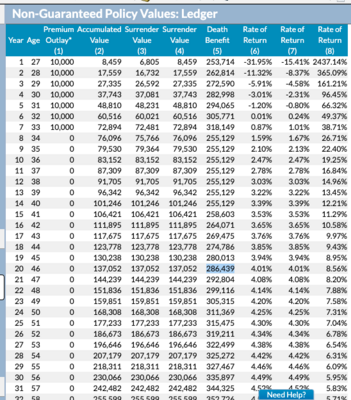

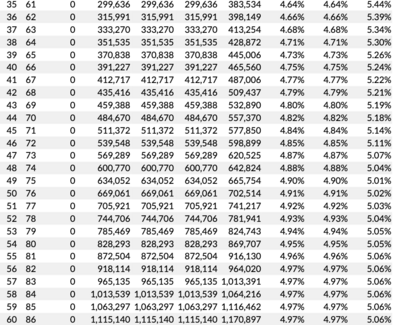

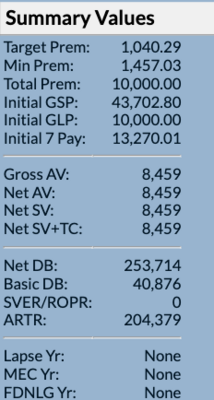

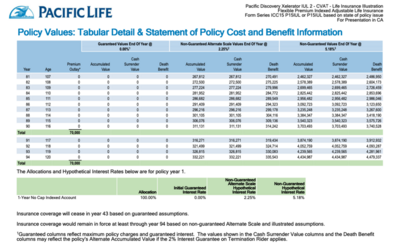

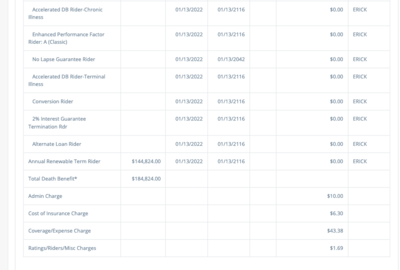

I am receiving $355 in commission I don't know what you want me to say. That is the illustration that was sent to the home office and they issued the policy.For a 10k/yr max funded policy?

Your attachment doesn't work but expenses don't equal commissions...you know that, right?