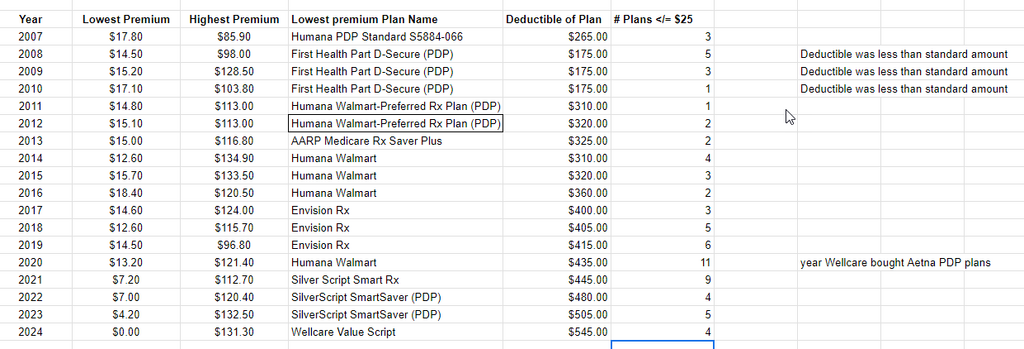

What about those also paying high irmaa on pdp, and can self insure RX? I have a handful already. If pdp premiums are HIGH at $20, and they now have a $0 wellcare plan, I promise u the question will come up if on no drugs or generics. I don't advise it, no agent should.Yagents wrote: "If PDP rates are minimum $20+ month, many of those on generics or no drugs are going to start considering the potential costs of PDP LEP vs the premium, And drop their PDP"

Wow, talk about penny-wise and pound-foolish! Wait till somebody needs one of those $16,000 a month cancer drugs and has no coverage. BIG mistake. People who ignore good advice do so at their own peril.

That said, some will want to "move in" with a sibling in another state to create a SEP. If you were their agent, what would you do?

But, with Part B and med supps premiums rising, people will be looking to cut costs