- 1,411

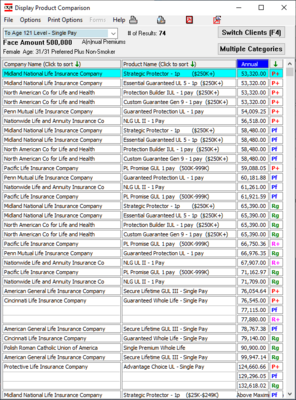

So NO ONE wants to guesstimate investment returns for the mid to long term. And yet I know that EVERY agent who goes into a sale does that when they sell investment products. So much for transparency. It's also why no one ever had to apologize for selling a product that is FULLY guaranteed.