- 5,054

agree with your information...but I think you are incorrect on this point.As an FYI: Starting (if single) at $50,001/yr with social security alone people have taxable income. At the max SS someone can get they will pay taxes on $2,119.00 (if single). Of course that is not a lot of money to have to pay taxes on. BUT if they have other sources of income that gets added to that and they will owe more taxes..

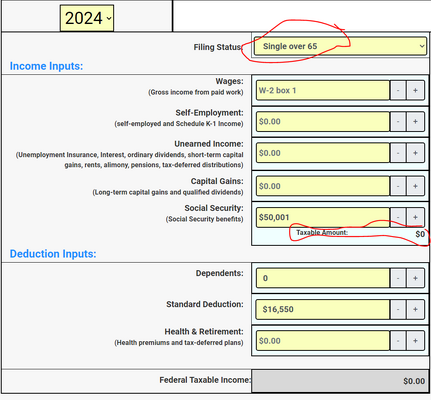

Are you using wrong filing or incorrect standard deduction. Someone single over 65 can have $50,001 SS & still have $0 of it taxable & pay no federal income taxes.

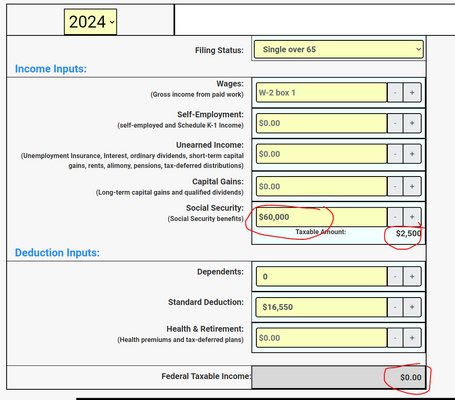

They would need to have $60,000 of SS to have $2500 of it taxable, but would still not owe federal income taxes because of how Provisional tax rate is calculated (unless this software is wrong this year)

Some people miscalculate the Social Security Provisional Income calculation. In that calculation to see how much of Social Security is taxable, it only uses 50% of the SS checks plus AGI to determine if the person is over the 50% or 85% level. IE: $50k SS & no other income= 1/2 of $50,000 = $25,000. No SS taxable. IE: $60k SS & no other income = 1/2 of $60k = $30k, so 50% of the checks over $25000 are taxable. So, 50% of the $5,000 excess = $2,500 that is added to taxable income. Standard deduction wipes it away.

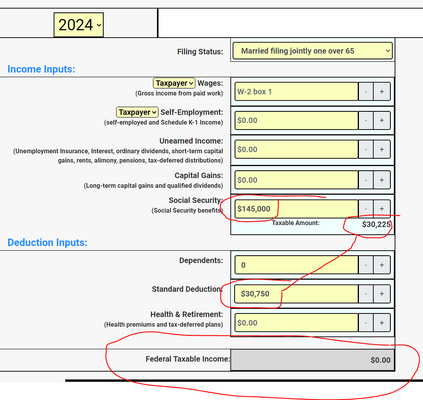

A married couple over age 65 could even have $145k of SS checks (if that was possible) & wouldnt owe any federal income taxes nor have to file a tax return. It is because at $145k, only $30k is added to taxable income & with no other income, the standard deduction wipes it all away