DidClient just called and left a message she wants to switch from United as she doesn't trust them paying claims . It's ironic as hell because United by far has the most customer loyalty because they have the most lenient preauthorization of all the carriers I sell . My clients have the most loyalty with United

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Breaking - UnitedHealthcare CEO Brian Thompson shot and killed outside Manhattan Hilton hotel

- Thread starter straightnochaser

- Start date

- 2,133

Police in Altoona – about 280 miles from the Midtown Manhattan hotel where UnitedHealthcare CEO Brian Thompson was fatally shot – responded to the call, picked up the man and searched him, the sources said. The man also had some documents investigators want to examine as potentially relating to motive, though further details on them were not clear.

Altoona police are waiting for NYPD detectives, who are en route.

- 2,172

Police in Altoona – about 280 miles from the Midtown Manhattan hotel where UnitedHealthcare CEO Brian Thompson was fatally shot – responded to the call, picked up the man and searched him, the sources said. The man also had some documents investigators want to examine as potentially relating to motive, though further details on them were not clear.

Altoona police are waiting for NYPD detectives, who are en route.

Exclusive | Luigi Mangione, suspect in UnitedHealthcare CEO Brian Thompson killing, was an ivy league grad with a grudge against the healthcare industry

The suspect nabbed in the killing of UnitedHealthcare CEO Brian Thompson is an anti-capitalist Ivy League grad who liked online quotes from “Unabomber’’ Ted Kaczynski — and seethed in a three-page …

Special Agent

Guru

- 659

Exclusive | Luigi Mangione, suspect in UnitedHealthcare CEO Brian Thompson killing, was an ivy league grad with a grudge against the healthcare industry

The suspect nabbed in the killing of UnitedHealthcare CEO Brian Thompson is an anti-capitalist Ivy League grad who liked online quotes from “Unabomber’’ Ted Kaczynski — and seethed in a three-page …nypost.com

some ivy leaguer friends and family have some splaining to do why they didn't drop the dime on this guy.I mean if a McDonalds employee who has never met him recognized him from the online pics we know someone who knows him definitely did.

ValeRosso

Guru

- 637

His manifesto was posted. His mom had neuropathy issues and UHC denied repeatedly, limited consultations to 2x per year, denied advanced imaging, prior auths took weeks then months, etc etc.

- 5,054

This is just not true according to IRS stats. Because of the standard deduction & the fact that Social Security isn't directly reported as fully taxable income, the vast majority of seniors no longer even have to file an income tax return & most are in the 0% tax bracket.The average before tax income for a retired couple in the US is over $90k per year. Median is over $50k.

Anyone who thinks that retirees pay no taxes, is living in a fantasy world. Its the #2 worry people cite for their retirement, right after outliving their assets.

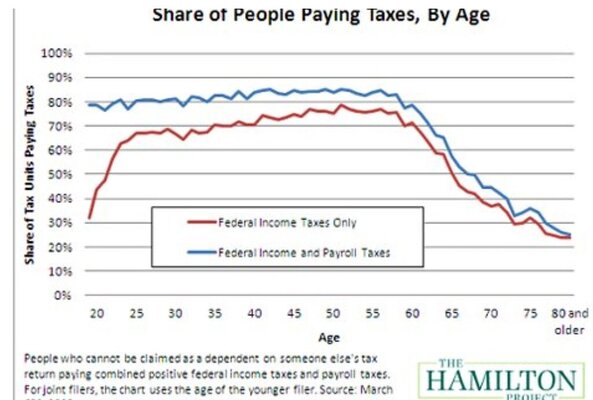

Attached is a chart, when standard deductions were lower than today, showing 70% of seniors over age 70 pay no federal income taxes. (Not saying they should, just sharing IRS stats).

A few years ago when CD rates were low, my dad didn't need to file a tax return or owe income taxes even though he has the largest SS checks I have ever seen(mom who passed away maxed earnings & delayed SS until 70) $60k SS, 8k interest. But he has almost $2M in NQ Annuities, CDs, another $1M in property. Not sure someone with almost 70k income & $3M in assets they are not drawing interest from should be in 0% tax bracket. Now, with CDs paying 4-6%, his annual taxable interest is about 60k. Now, on his 120k a year total income, he pays about 13% in federal taxes, but if those CDs were in Amnuity, he would still be in 0% bracket even though he would be making $200k a year in SS & Annuity interest growth........better for him to owe 13% on CD interest than for me to owe 35% on it in my tax bracket on inherited NQ annuity at his death

Also, not sure where your income stats come from, but average senior household income is 27k in US & this is why so few pay taxes as they don't make enough to live on & almost all of it is SS checks (average monthly SS is $1,800). I personally don't think at those income levels they should be paying what they do for Medicare premiums at all. [EXTERNAL LINK] - What Is the Average Monthly Retirement Income in Every State?

Attachments

Last edited:

This dude ditches his backpack in the park and then takes all of the evidence and stuffs it into a new backpack and carries it around with him?

apnews.com

apnews.com

I thought this kid was Ivy...

New York prosecutors charge suspect in UnitedHealthcare CEO killing with murder, court records show

Police have identified the suspect as 26-year-old Luigi Nicholas Mangione. Manhattan prosecutors filed murder and other charges against Mangione, according to an online court docket.

I thought this kid was Ivy...

Special Agent

Guru

- 659

His manifesto was posted. His mom had neuropathy issues and UHC denied repeatedly, limited consultations to 2x per year, denied advanced imaging, prior auths took weeks then months, etc etc.

Be interesting to find out if she had group UHC or an ACA plan or possibly a Short Term / Indemnity Golden Rule plan- which would explain a lot.Also interesting to know if she had one of those PCP who's office were just inefficient/incompetent dealing with managed care.I assume she was too young for medicare.I don't sell ACA or Employer plans so i don't know if UHC claim denials are worse than other carriers .I hear from feedback of my medicare clients that they usually like UHC EGHP better than Cigna,Aetna and BCBS while they were working .

Interesting that the social security administration and the IRS disagree on what percent of retirees pay taxes on their social security. The SS says, "About 40% of people who get Social Security must pay federal income taxes on their benefits. This usually happens if you have other substantial income in addition to your benefits. Substantial income includes wages, earnings from self-employment, interest, dividends, and other taxable income that must be reported on your tax return." Of course if they itemize that may bring down their taxable income.This is just not true according to IRS stats. Because of the standard deduction & the fact that Social Security isn't directly reported as fully taxable income, the vast majority of seniors no longer even have to file an income tax return & most are in the 0% tax bracket.

Continuing SS says, "You will pay tax on your Social Security benefits based on Internal Revenue Service (IRS) rules if you:

- File a federal tax return as an "individual" and your combined income*is

- Between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits.

- More than $34,000, up to 85% of your benefits may be taxable.

- File a joint return, and you and your spouse have a combined income*that is

- Between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits.

- More than $44,000, up to 85% of your benefits may be taxable.

- Are married and file a separate tax return, you probably will pay taxes on your benefits."

As an FYI: Starting (if single) at $50,001/yr with social security alone people have taxable income. At the max SS someone can get they will pay taxes on $2,119.00 (if single). Of course that is not a lot of money to have to pay taxes on. BUT if they have other sources of income that gets added to that and they will owe more taxes..

A May 2024 Federal Reserve document stated that 80% of retirees had other sources of income besides SS (of course this doesn't mean they had enough extra to have to pay taxes): "This included 56 percent of retirees with income from a pension; 48 percent with interest, dividends, or rental income; and 33 percent with labor income". Later in that article they stated, "Most adults had tax-preferred retirement accounts, defined benefit pensions, or other assets that they may be able to tap to meet expenses in retirement. Sixty-seven percent of adults had assets that are specifically designated for producing income in retirement, including the 60 percent of adults who had a tax-preferred retirement account, such as a 401(k) plan through an employer, individual retirement account (IRA), or Roth IRA, and 29 percent who had a defined benefit pension through an employer"

As a result it would seem likely that most of the people counted in the Federal Reserve research and according to SS 40% would be paying at least some taxes if they had anything in addition to social security (and the small group that has close to max social security). If the IRS says 30% are paying taxes on their SS then obviously some are in luck when itemizing deductions.

What I found sad was that the Federal Reserve found 15% of retirees had to either cash out retirement funds or borrow from them to pay for medical expenses.

Similar threads

- Replies

- 58

- Views

- 2K

- Replies

- 4

- Views

- 243

Latest posts

-

-

Los Angeles Fires Become Existential Test for California’s Stopgap Insurer

- Latest: marindependent

-