- 591

Just read this in the news. Might make some switch to Advantage plans over Suppliments. Thoughts?

CMS Officially Adds Non-Skilled In-Home Care as Medicare Advantage Benefit

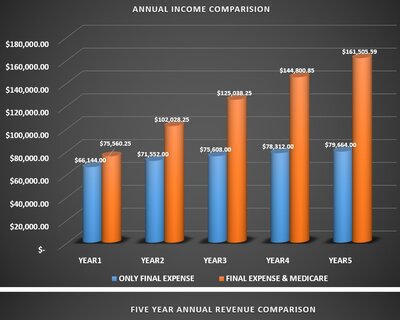

This trend looks like it's going to continue for at least the next few years. Coupled with relaxed standards (48 hour scope no longer in play), the new OEP and overall growth of the market there's going to be plenty for everyone.

AARP announced yesterday that they are going to be paying lifetime renewals on Med Supps (In limited markets). I also just got an email this morning that Aetna is upping their comps on Plan N so that agents earn as much as what they would selling a Plan G. All of this has to be in response to the strong growth of MAPD in relation to Med Supps.