MouseMouth

Expert

- 31

Like many here I will be losing a good amount of money if Wellcare does not pay my commissions on my clients that will auto-renew. I have asked Wellcare management to qualify whether the non-payment of renewals means for PDP clients that happen to move to Wellcare this year, or does it target my existing book renewals? I have not seen any written communications from Wellcare on the subject.

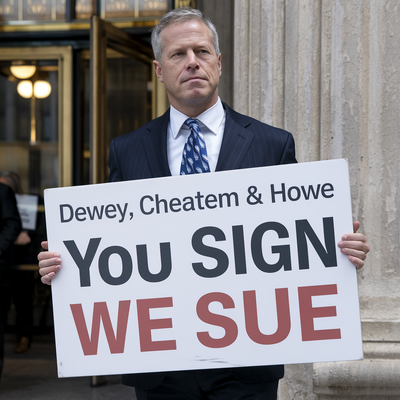

If indeed they are cutting the existing-client renewal commisions, is anyone working on a class action lawsuit ? I know that other people have negative opinions about class actions, but this one would not be typical. In this case the damages are easy to quantify, and the aggrieved pool is easy to identify and qualify. A case like this one should be just actual damages, plus legal fees plus legal expenses . With 6 million members, even if only half are agent sold, Wellcare is taking some $150 million from agents. I think these numbers are suffcient to interest decent attorneys.

I know many will be reluctant to do anything, preferring to bellyache and retaliate against Wellcare, however, we should be clear that if one carrier does this and gets away with it, the rest of them will sit up, take notice, and see such a strategy as a way to improve the bottom line in difficult times. What if some decide that regular MAPD's are also targetable? This could be an industry destroyer if we do not respond. At my age, I am just not ready to re-invent myself for what would be about the fifth time.

If someone else has some process started, I will be happy to join. If not, then I will start talking to some attorneys and see if there is any interest.

If indeed they are cutting the existing-client renewal commisions, is anyone working on a class action lawsuit ? I know that other people have negative opinions about class actions, but this one would not be typical. In this case the damages are easy to quantify, and the aggrieved pool is easy to identify and qualify. A case like this one should be just actual damages, plus legal fees plus legal expenses . With 6 million members, even if only half are agent sold, Wellcare is taking some $150 million from agents. I think these numbers are suffcient to interest decent attorneys.

I know many will be reluctant to do anything, preferring to bellyache and retaliate against Wellcare, however, we should be clear that if one carrier does this and gets away with it, the rest of them will sit up, take notice, and see such a strategy as a way to improve the bottom line in difficult times. What if some decide that regular MAPD's are also targetable? This could be an industry destroyer if we do not respond. At my age, I am just not ready to re-invent myself for what would be about the fifth time.

If someone else has some process started, I will be happy to join. If not, then I will start talking to some attorneys and see if there is any interest.